Bitcoin and Environmental Impact

Summary

This article is an attempt to flesh out the persistent question of proof of work (PoW) consensus - specifically bitcoin mining - and its environmental impact. After outlining a few caveats as well as framing a historical background, we divide the argument into two broad considerations. First, we address some of the key data points and research models used by subject matter experts to arrive at certain conclusions related to transaction volume, the role of Chinese mining, and analogies with centralized payment systems. Next, we consider the political and psychological precepts an individual may apply to this topic and how that may inform an opinion or cause one to avoid legitimate criticisms altogether. As bitcoin's market price continues to appreciate in value, so too does its consumption of energy and other resources. The Fugue Foundation is a nonprofit organization dedicated toward using novel, open source technologies (such as decentralized blockchains) to further the principles of effective altruism in addition to being responsible stewards of the earth's resources. We hope that our distillation of this complex and multi-faceted debate will help inform our own decisions and perhaps assist other organizations to properly evaluate what role these types of cryptocurrencies may have in their own finances and donation strategies.

Caveat Emptor

We are not climate scientists, nor energy experts, nor financial advisors, nor do we possess unique insight into Chinese mining operations. Our intent with this article is to help ourselves, and perhaps others, to consolidate conflicting viewpoints, separate fact from fiction, and distinguish signal from noise. We opt for brevity, summation, aggregation, and links to resources to empower others to formulate their own opinion rather than presenting a comprehensive dissertation-like exposition.

While there are many PoW blockchains in existence (Litecoin, Bitcoin Cash, Monero, Ethereum, Dogecoin, and more), many with unique mining protocols and additional considerations when calculating environmental impact; as it represents approximately 60% of the total market capitalization of all cryptocurrency our focus will be solely on Bitcoin.

We note that the Fugue Foundation builds on and uses resources within the Ethereum ecosystem, a PoW smart contracting platform with the second highest token by market cap, whose mining hash power is approximately six times smaller that of Bitcoin. However, Ethereum is unique among other PoW chains as it has an extensive number of layer 2 solutions that currently or soon will improve transactional efficiency. More importantly, the entire network is in the process of transitioning away from PoW to proof of stake (PoS) consensus and will therefore eventually use significantly less electricity - perhaps 99.98% less - to secure and validate the network. Bitcoin conversely, due to many cultural and technical considerations within the expansive bitcoin community, seems unlikely to ever make a similar transition away from PoW consensus.

However, like many others in the crypto space we have roots in Bitcoin, BTC is a token that plays a role in our donation strategy, and we are historically proponents of its use case and value proposition. At the same time, we care about the future of our planet and its resources, which for some detractors may be seen as contradictory. And so we undertake our due diligence in good faith and with an open mind, focusing on solutions whenever possible and always hoping to advance the conversation in an arena of competing ideas.

Mindset

Putting to one side for a moment the hype surrounding it today, for this discussion it's important to bear in mind Bitcoin's humble origins as an open source project anonymously gifted to the world, an experiment in cryptography and an alternative to tradtional financial power structures. The Bitcoin genesis block was Promethean in hindsight. In only twelve years, it bootstrapped itself from an obscure code base maintained by a handful of enthusiasts into a network that stores over a trillion dollars in value. Whereas you could originally mine for it as a hobbiest using a laptop CPU and later GPUs, today only application-specific integrated circuits (ASICs) will make someone competitive to earn fees and block rewards, and then only when they pool resources with others globally. In other words, where Bitcoin started is unrecognizable from where it is today.

January 3, 2009 - Chancellor on brink of second bailout for banks - Words encoded into the Bitcoin genesis block

In a decentralized and distributed system, game theory tells us that there needs to be a mechanism to incentivize participants to cooperate. From the genesis block, the new coins that comprise the block reward within each new block have been distributed by creating a competition in which miners surrender something valuable – energy – in exchange for the right to claim them. To Satoshi Nakamoto, he had no other way to fairly, and in a decentralized manner, issue units of digital value to the world. Mining is a radically free market and miner margins are usually slim. Other distribution methods (airdrops, initial coin offerings, faucets for instance) have subsequently revealed a variety of lessons learned, with criticisms ranging from network participants either ignoring or abusing the distribution, to big venture funds front-running the entire supply or bequeathing a large percentage of coins to founding members.

"It’s the most simplistic and fair way for the physical world to validate something in the digital world. PoW is about physics, not code. Bitcoin is a super commodity, minted from energy, the fundamental commodity of the universe. PoW transmutes electricity into digital gold. The Bitcoin ledger can only be immutable if and only if it is costly to produce. The fact that Proof of Work (PoW) is “costly” is a feature, not a bug. Until very recently, securing something meant building a thick physical wall around whatever is deemed valuable. The new world of cryptocurrency is unintuitive and weird — there are no physical walls to protect our money, no doors to access our vaults. Bitcoin’s public ledger is secured by its collective hashing power: the sum of all energy expended to build the wall." Source

Again, this article is not meant to be authoritative or reductionist. But with this historical backdrop in mind, we have found the debate of today to broadly divide along two lines which we address below. The first pertains to the data and ones reading of that data. The second relates to normative thinking and the subjective opinions extending from it.

Data Driven Analysis

Data rarely speaks for itself and this topic is no exception. There are statistics, and there is one's interpretation of those statistics. Let's start with what we found to be some of the core assumptions shared by both sides of this argument.

- PoW chains empirically and theoretically will consume energy in direct proportion to the value of the coin price.

- Bitcoin's energy consumption seems to be non-rivalrous, meaning that its use does not seem to be depriving others of that same energy. However, the rivalry between a demand for mining hardware and the manufacturing of semi-conductors is disputed.

- In order to account for margins of error, models tend to employ a lower bound (best case) and upper bound (worst case) approach to data aggregation. This incorporates data points like mining hardware used, presumed energy source relative to the miner's geographic location, and much more.

Transaction Volume

One of the frequently seen metrics we encountered is energy consumption per transaction, followed by comparisons with other seemingly related transactional systems. For example, Bitcoin only can handle about 350,000 transactions a day and so it would require 14x the world's total electricity just to process the 1 billion credit card transactions that take place every day. This line of inquiry is problematic and opens up elaborate conversations about monetary policy and financial systems. However, the following considerations with either direct or indirect relation to better understanding transactional volume caught our attention.

- At time of writing, bitcoin miners earn around $50 million/day, which annualizes to around $18.2 billion in miner revenue. Fully 85% of that revenue derives not from per-transaction fees, but from the issuance of new bitcoins. This issuance process is finite: in fact, it’s 88.7% done. The rate of new coin issuance halves every four years as it approaches that 21 million limit. It is unclear how the value proposition of bitcoin (from the miner's perspective) will change as the block reward continues to be cut in half every 210,000 blocks (about four years).

- U.S. Markets are walled gardens with inconsistent access to resources among participants and are open 253 days per year for 6.5 hours a day, which equals 1,644 trading hours. Crypto markets, however, are open 365/24/7, which equals 8,760 trading hours. In other words, generating bitcoin transactions are not only permissionless (i.e., open to everyone with an internet connection) but are available approximately 5x that of traditional brokerage.

- The main utility of Bitcoin’s PoW is to secure an economic history. A bitcoin “accumulates” the energy associated with all the blocks mined since its creation. LaurentMT, a researcher, has found empirically that Bitcoin’s PoW is indeed becoming more efficient over time: increasing cost is counterbalanced by the even greater increasing total value secured by the system.

- The "Bitcoin is a battery" argument is interesting, though contested. Energy producers can plug in miners, and store their excess power as bitcoin, which is conceivably analogous to, for example, aluminum smelting in Iceland as an "energy export" making use of stranded and abundant renewable energy resources. Those who contest this analogy tend to dispute the arguments supporting bitcoin as a store of value.

Payment vs. Settlement

Leading on from a discussion of transactional volume is the question of what exactly a bitcoin transaction represents and confers on the network and by extension the world. In brief, one transaction does not necessarily equal one payment, and in general within the context of a mining debate it is more accurate to think in terms of blocks. More importantly, the Bitcoin network as a whole should be seen not in terms of Visa-like payments but as a global settlement layer with true finality of a transaction between two or more counter-parties. Additional considerations include:

- The Bitcoin network now transfers $137,000 per second around the world without requiring a bank, government, or third party. This metric can be compared to 80 ounces of gold being sent via the internet across the world every second. Bitcoin transfers are not like Visa or PayPal, that only shift around a few numbers on their database. This is final settlement, with no liablities or credit. Source

- Any comparisons with a payment system such as Visa needs to incorporate Visa's reliance on other systems within the "stack" of its financial system (i.e., Fedwire, ACH, Swift, private/central banks). A Visa transaction does not achieve settlement or finality.

- Transaction throughput (i.e. the number of transactions that the system can process) is independent of the network’s electricity consumption. Adding more mining equipment and thus increasing electricity consumption will have no impact on the number of processed transactions. The energy spent is per block, which can have a varying number of transactions. More transactions does not mean more energy.

- Any meaningful discussion on this topic requires an understanding of various scaling/layer 2 solutions, where each unit of energy is securing exponentially more and more economic value. For example:

- Segregated Witness

- Batch processing and the role of centralized exchanges

- Layer two solutions like the Lightning Network

- Briefly, Lightning makes two transactions with the bitcoin network (to open and ultimately close a channel) but in the interim an indeterminate number of transactions could occur. Think opening a bar tab and ordering drinks over the course of weeks but only paying when you close the tab.

China

Bitcoin annually consumes approximately 135.59 TWh of electrcity with total carbon dioxide emissions not exceeding 58 million tons of CO2, or roughly 0.17% of the world’s total emissions (see various global comparisons here). At least 39% is believed to have originated from renewable sources, with an estimated 65% of BTC mining occuring within China. Please take these numbers in stride: there are volumes of data on this, partly due to the hyper-transparency of the Bitcoin network's metrics, as well as numerous methodologies for distilling this data. Moveover, the whole picture is difficult to portray, notably because:

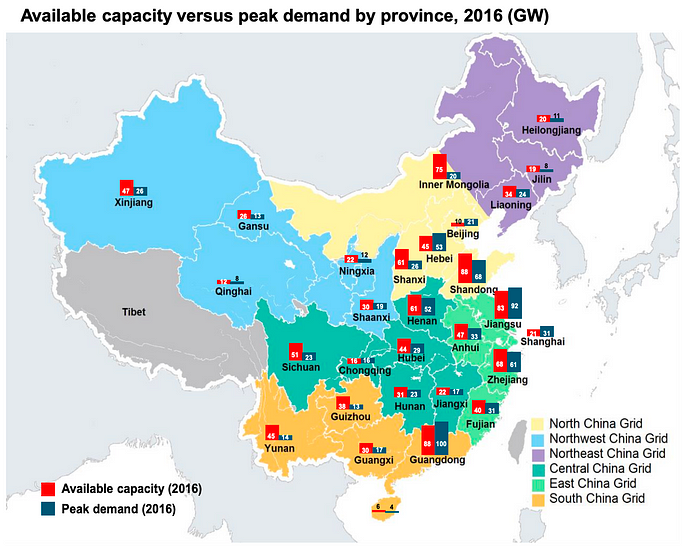

- Certain provinces (Sichuan, XinJiang, Yunan, and a few others) dominate China's percentage, and there are considerations unique to each location (i.e., Sichuan has a lot of hydroelectric) and energy consumption can vary seasonally. Thus it’s not appropriate to map China’s generic CO2 footprint as a whole to BTC mining.

- Chinese mining pools do not always reflect the geographic diversity of its participants

- e-Waste created by next generation ASICs being introduced (and out-dating older hardware) is another dimension to this conversation worth considering

Comparisons of the global Bitcoin network with the electrical footprint of another country can likewise be more difficult than banner headlines let on. For instance, the U.S. electrical grid is (for the most part) interconnected in such a way so that power can be re-distributed across state lines as necessary or practical. However, this is often not the case in China. Rather, it is a country comprised of 1000s of energy plants supporting their immediate (often lower income) surroundings, which is to say that unused power is equivalent to wasted power (so-called "stranded energy"). Since the physical location of mining centers is not important to the functioning of the Bitcoin network, miner operations in China frequently make use of these plants due to the economic incentives (cheap and abundant electricity), which some have argued makes Bitcoin similar to a battery that stores otherwise wasted energy as value.

Normative Arguments

Normative behavior or thinking is the phenomenon in human societies of designating some actions or outcomes as good or desirable or permissible and others as bad or undesirable or impermissible. Naturally, this line of thought leads to ends-justify-the-means arguments, both white and green washing of events or facts, and what-about-isms.

Bitcoin is consuming more energy than ever, irrespective of whether that energy comes from renewable or stranded sources. As the price rises so too does the electricity consumption. If you don't believe Bitcoin is useful, you're inclined to believe all the energy it uses is a waste. Whether entity "X" has an entitlement to consume any of the world's resources is effectively a rhetorical question with an answer that is somewhat irrebuttable. If you fundamentally contest the validity or relevance of a network, you will naturally consider its energy usage illegitimate.

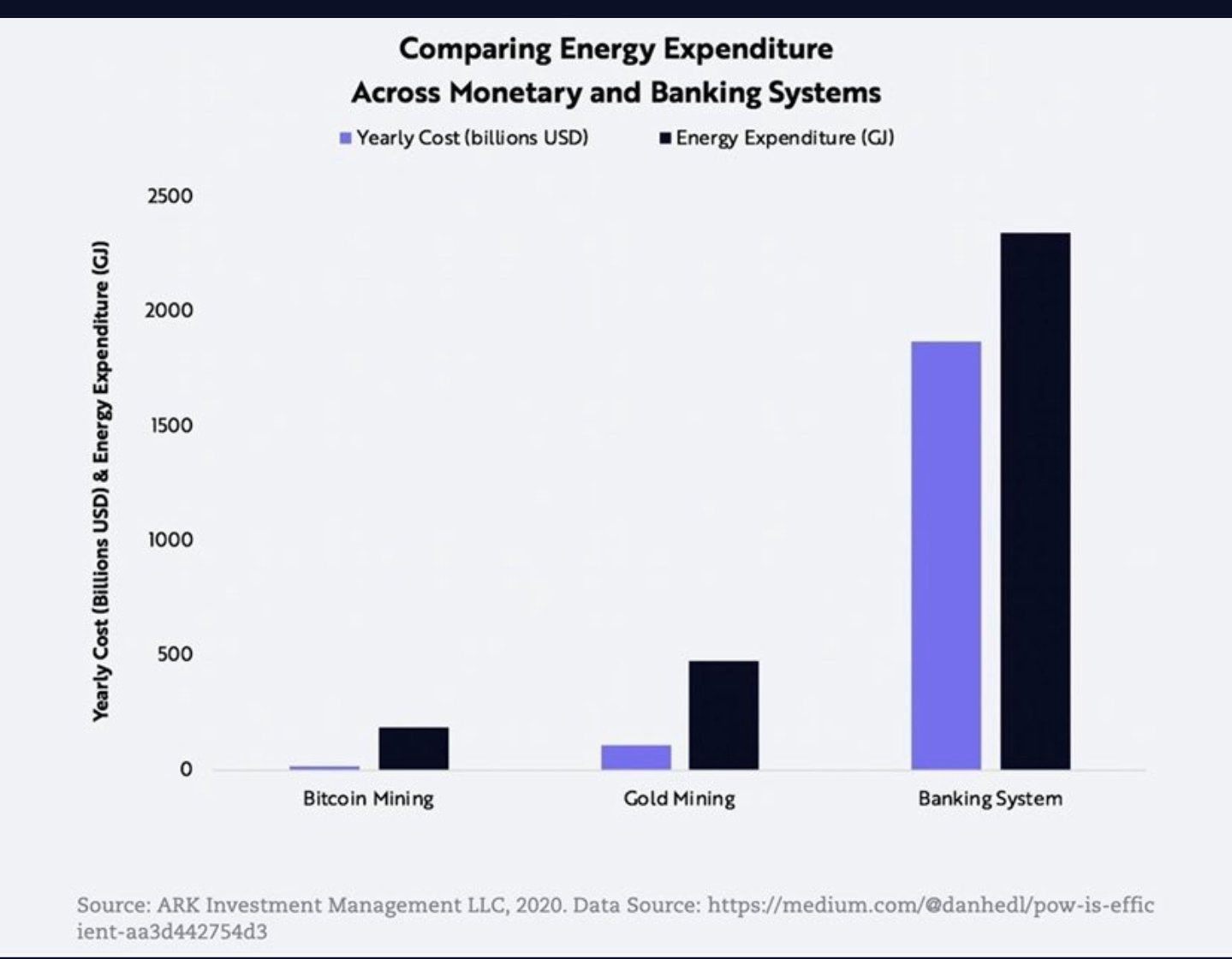

Despite the challenges that exist for tabulating Bitcoin's energy consumption, the network as a whole is incredibly transparent in its energy use relative to other industries. It is also a fierce example of free market capitalism: If people find that electricity worth paying for, the electricity has not been wasted. Those who expend this electricity are rewarded with the bitcoin token. The world-eating feedback loop that has been hyped in the press can be just as disingenuous as avoiding a question by drawing comparisons to other massive energy consumers. An interesting counter-narrative here is that PoW incentivizes more power consumption as the aggregate crypto market capitalization increases. The price of bitcoin goes up, so more people mine. The same could not be said for hanging Christmas lights. However, it could for example be argued against gold mining or, more broadly, against meat consumption, both of which have a tremendous detrimental impact on the environment.

Politics

Applying normative thinking to the intersection of environmental conservation and cryptocurrency gets very political, very quickly. Here are some of the more poignant arguments we encountered during our research, for better and for worse, presented here to provoke independent thought. One's response to them will vary radically depending on national identity, intellectual honesty, economic incentives, access to traditional financial resources or stable sovereign currencies, and much more.

- A real problem with addressing criticism of Bitcoin is that so many powerful people have cried wolf about it in the past, making many in the community numb or indifferent to any criticism. Its initial enthusiasts believed — and many still do — that cryptocurrency is going to undermine central banks and take over from fiat currencies like the U.S. dollar. That has led some to decry Bitcoin as a plot to bring down governments.

- Bitcoin ultimately punishes governments (like Iran and Venezuela) that uneconomically subsidize energy to maintain regime legitimacy. If you dislike the environmental impact of nonrenewable subsidies and dislike the authoritarian states that employ them, Bitcoin’s subsidy-toxicity is a potential net benefit.

- Bitcoin’s utilization of the excess electrical capacity consumes magnitudes less electricity than existing fiat systems which not only have power requirements for banking infrastructure and the various layers of a debt-based payment system, but for the military and political machina that underpin the State.

- Though not necessarily related to the crypto mining industry specifically, the United Nations is "gravely concerned about the human rights situation in XinJiang" (where a sizeable percentage of Chinese mining occurs), which is at least a reputational consideration for investors. More

- Bitcoin searches in Turkey spike 566% after Turkish lira drops 14% - The use case for bitcoin is quite different for citizens who earn wages in a highly inflationary currency.

Solutions

- Bitcoin Firms Team Up to Launch 'Clean Energy' Mining Venture

- "Miners use a variety of power sources globally from nuclear, to hydro, to coal, and many miners are already using renewable sources of energy. The major pools (primarily based in China) do not care what power sources the miners connecting to them are using. This is what makes Terra Pool different — we have a mandate and guiding principles."

- Square Puts $10 Million Toward a Cleaner Bitcoin Ecosystem

- "We believe that cryptocurrency will eventually be powered completely by clean power, eliminating its carbon footprint and driving adoption of renewables globally." Square co-founder and CEO Jack Dorsey

- Bitcoin Clean Energy Initiative (BCEI): Bitcoin is Key to an Abundant, Clean Energy Future

- Aker launches Seetee to invest in Bitcoin and blockchain technology

- Seetee will establish mining operations that transfer stranded or intermittent electricity without stable demand locally—wind, solar, hydro power— to economic assets that can be used anywhere. Bitcoin is, in our eyes, a load-balancing economic battery, and batteries are essential to the energy transition required to reach the targets of the Paris Agreement. Our ambition is to be a valuable partner in new renewable projects.

- Renewable Energy Crypto Mining - Traditionally renewable energy sites have sold their electricity to the grid for a fixed tariff payment (FIT). Crypto mining proposes using your energy on site powering computer servers and then you get paid for renting out the computer power your servers produce. This in turn helps renewable energy providers expand their operations.

- Carbon offsetting blockchain transactions 1 2

- Next generation protocol for pooled mining, focuses on making data transfers more efficient, reducing physical infrastructure requirements for mining operations, and increasing security. Stratum v2

- Corporate Influence - This is a somewhat hypothetical example, albeit a plausible one. Tesla's mission is to accelerate the world's transition to sustainable energy. And not only does this publicly traded company hold over $1B of BTC on its balance sheets but customers are now able to purchase their vehicles with BTC (a type of carbon offset in itself). This creates an incentive for Tesla to advocate and/or support efforts to make the PoW space more environmentally friendly. We note there have been counter arguments to this theory.

- Levying a tax on coin mining activity or create tax incentives to set up shop in districts with abundant hydroelectric resources.

Conclusion

There is no they behind Bitcoin, only an us. The apparent inefficiencies of consuming electrity to use computational resources to solve complex math are what is required to preserve the decentralization and censorship resistance of the network it secures. Being inefficient is a feature, not a bug, employed to prevent both rogue actors and colluding opportunists from gaining control to dominate the network. We are free to debate whether such a non-state, synthetic monetary commodity is relevant or useful within one's place in the world, or whether there are better ways to accomplish the same thing (i.e., PoS), but when we do so we have somewhat changed the subject.

The headline grabbing articles from the mainstream media that traffic in sensationalism, the Cryptopocalypse hyperbole of the Twitterverse, the white/green-washing of a legitimate concern about energy consumption from hodlers with a vested interest; we see this as noise. The signal is found in an honest, frank discussion about the data and finding how best a blockchain-based value transfer system reduces its energy consumption without compromising security or decentralization. We at the Fugue Foundation are optimistic about the future of this emerging technology and look forward to harnessing its benefits and improving its flaws in an effort to be effectively altruistic for many years to come.

References and Resources

- PoW is Efficient

- The Frustrating, Maddening, All-Consuming Bitcoin Energy Debate

- Bitcoin Energy Consumption Index

- Bitcoin Mining Map - University of Cambridge

- Noahbjectivity on Bitcoin Mining

- Bitcoin and other PoW coins are an ESG nightmare

- Bitcoin Miners Are on a Path to Self-Destruction

- China’s Renewables Curtailment and Coal Assets Risk Map - Bloomberg

- Bitcoin mining energy consumption

- Response to Mora et al

- carbon.fyi